who claims child on taxes with 50/50 custody georgia

When You Have 5050 Custody Who Claims The Child On Taxes. I was told that IRS required a parent with higher AGI to claim a child as a dependent when we have the pure 5050 physical and legal custody.

Child Support Vs Custody Therugbycatalog Com

A custodial parent will often make an argument on behalf of hisher joint physical custody of their child in most cases.

. It is the parent who spends the most time with the children. As a result of split 5050 child custody agreements parents with high incomes can claim their children as dependent citizens. However there are exceptions to.

Typically when parents share 5050 custody they alternate between odd and even years on which parent claims the child. Who claims child on taxes in case of joint 50 50 custody. There is no such thing in the Federal tax law as 5050 split or joint custody.

Find the best ones near you. Again the rule for claiming children on your taxes is relatively simple. The dependency exemption cannot be split.

But there is no option on tax forms for 5050 or joint custody. If the other parent with lower AGI were to file I do need to provide a form allowing him father to claim the child. He must file with his tax return IRS Form 8332 Release of Claim to Exemption for Child of Divorced or Separated Parents signed by the mother.

Is there such a thing as 50 50 custody. But what happens when both parents share joint custody of a child and split the custody time equally 5050 then who is the custodial parent for tax purposes. How to Enforce a Child Custody Order in.

You who can claim a child ontaxes in a 5050 custody - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website. Basically the custodial parent claims the dependent child for tax benefits. But there are ways to change the default rule.

Who Claims a Child on Taxes After a Custody Case. When both parents claim the child the IRS will usually allow the claim for the parent that the child lived with the most during the year. The IRS only recognizes physical custody which parent the child lived with the greater part but over half of the tax year.

The other parent is. Oftentimes what is done with 50-50 custody is that the parents alternate claiming the child year to year. But if the father furnishes over 50 of the childs support he is entitled to the exemption.

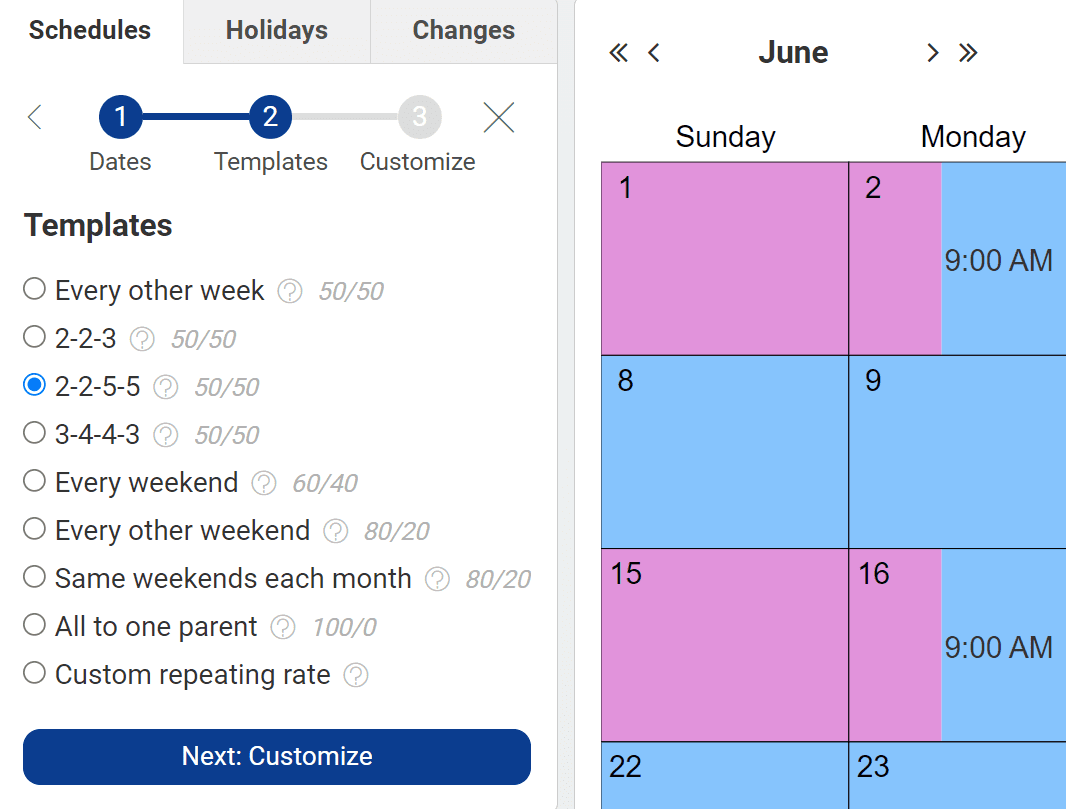

When parents divorce or separate the law allows only one of them to claim their child as a tax dependent. Section 152 This usually means the mother because she most often gets primary physical custody. We elaborate on these 50-50 schedules in this post.

8601 Georgia Avenue Suite 206 Silver Spring Maryland 20910. Avvo has 97 of all lawyers in the US. Who claims child on taxes with 5050 custody michigan.

Under a state-mandated worksheet it is assumed that the person who is receiving child support is the person who is also going to claim the child on taxes. Receive a monthly email newsletter with insider information and special offers. Generally the custodial parent is treated as the parent who provided more than half of the childs support.

California law states that in split 5050 child custody agreements the parent with the higher income can claim the child as a dependent on taxesHowever most cases involve the custodial parent with joint physical custody claiming the deduction. Who Claims A Dependent Child On Taxes With 5050 Custody Brad Pitt flared up to claim 5050 custody with Angelina Jolie in court today Details It is that time of year. By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them.

So be careful if you split visitation and custody time equally 5050. How State Courts make Child Custody Decisions. By default the IRS gives this right to the custodial parentthat is the parent with whom the child lives for more than half of the year.

The father insists this rule does not make any sense as he feels I benefit from the dependent care credit. Who claims child on taxes with joint custody. Who Claims a Child on Taxes After a Custody Case.

This parent is usually allowed to claim the exemption for the child if the other exemption tests are met. Want to stay in touch with Colorado Legal Group. I provide more than 50 support and.

Make sure you are correct in filing as head of household status because if not you can assure an audit is not too far away. That parent is the custodial parent. Transferring Tax Credit to Your Ex in a 5050 Custody Arrangement.

In this way both parents if eligible have the opportunity to. Which parent claims the children on taxes with equal parenting time can be decided between the parents and with the help of an accountant you both may be able to work out an arrangement that saves you both on taxes. However if the child custody agreement is 5050 the IRS allows the parent with the highest income to claim the dependent deduction.

Understand the common factors your states judges use when making child custody decisions. Can Both Parents Claim a Dependent Child. When you have 5050 custody who claims the child on taxes.

There are also some other factors like who pays for the childs insurance and if there are any daycare expenses. Only the custodial parent may claim the child as a tax dependent and file as head of household. Before you can claim the child tax credit.

The irs rule is whomever has the kids for the majority of the time claims them and in cases with 5050 the parent providing more than 50 of their costs. The IRS usually gives the most tax benefits to the custodial parent. The only exception to this is if the court says otherwise or if the custodial parent signs a form called the Release of Claim to Exemption for Child of Divorced or Separated Parents.

There is no such thing in the Federal tax law as 5050 split or joint custody. Figuring out joint custody and child tax claims can feel confusing but youre definitely not the first people to go through this. In a joint custody agreement the custodial parent can claim the child as a dependent on their tax returns.

This is true for parents without an exact 5050 custody split Transferring tax credit to your ex in a 5050 custody arrangement. Taxes come to a head and confusion starts taking hold.

70 30 Custody Visitation Schedules Most Common Examples

Do I Have To Pay Child Support If I Share 50 50 Custody

Who Claims The Child With 50 50 Parenting Time Equal Griffiths Law

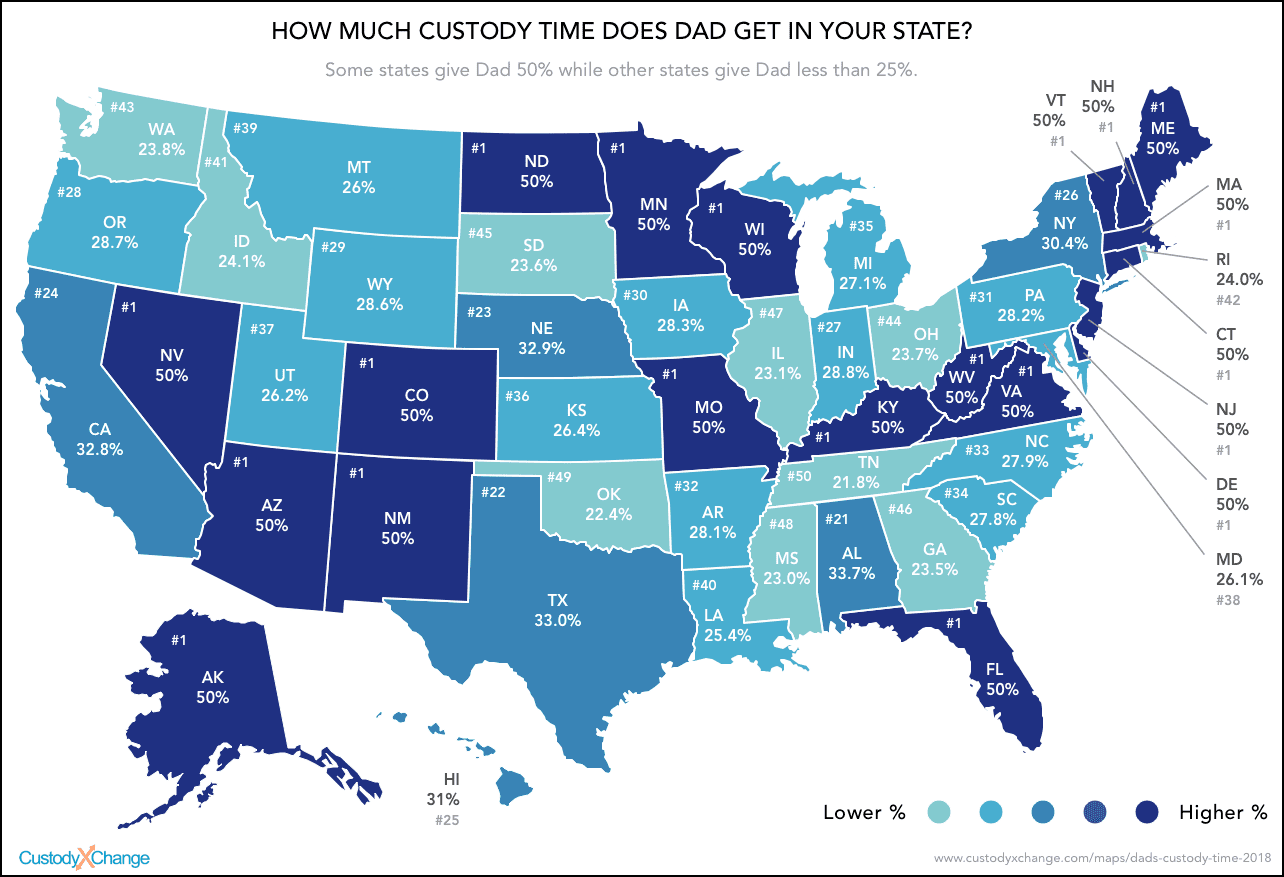

How Much Custody Time Does Dad Get In Your State

What Is Child Custody And How Does It Work Lawsuit Org

Who Claims A Child On Taxes With 50 50 Custody In California Her Lawyer

Florida 50 50 Parenting Plan 50 50 Custody And Child Support

Child Custody Archives Lawsuit Org

How To Create The Perfect Parenting Agreement With Examples

Florida 50 50 Parenting Plan 50 50 Custody And Child Support

How Much Custody Time Does Dad Get In Your State

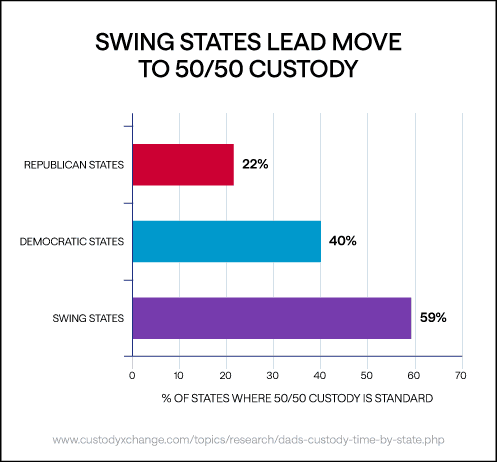

35 Divisive Child Custody Statistics

Georgia Child Custody Questions Cordell Cordell

Child Support Reform Promotes Involvement Closes Pay Gap

Do I Have To Pay Child Support If I Share 50 50 Custody

Florida Child Support 2022 Florida Family Law

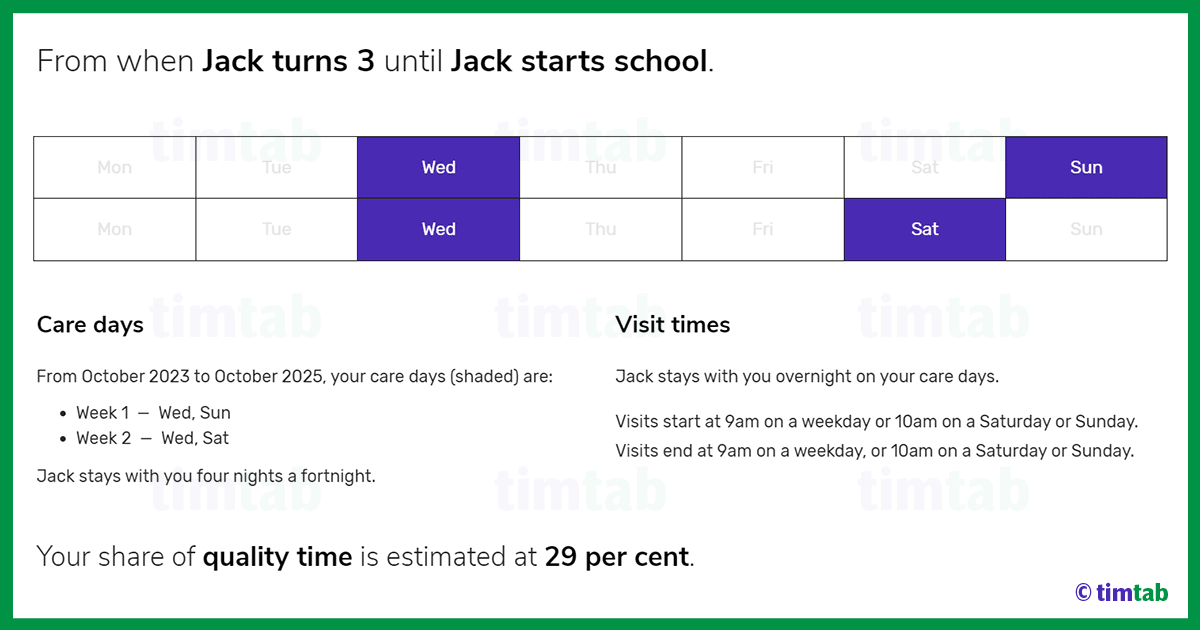

70 30 Child Custody Schedules Top 4 Plans Timtab